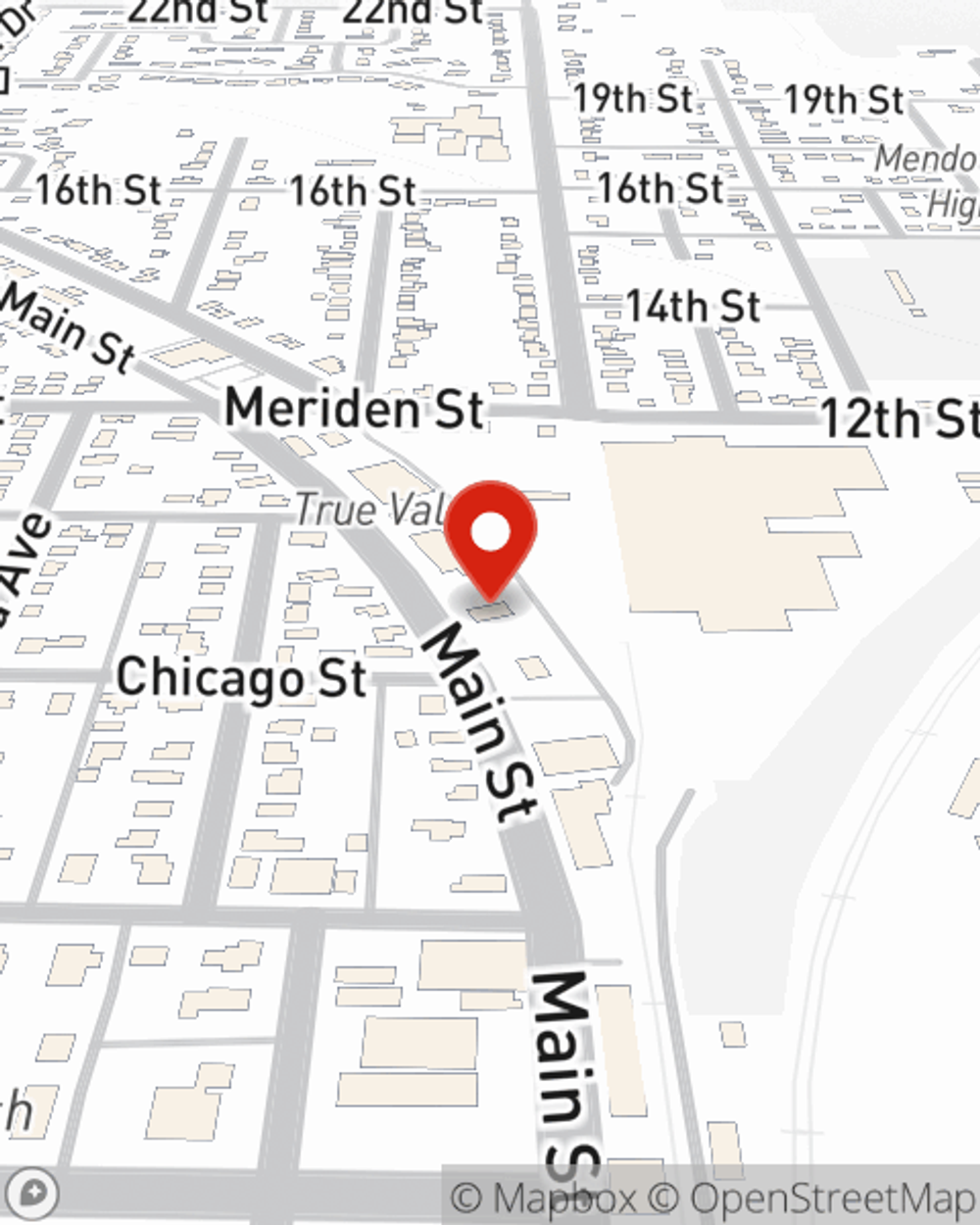

Renters Insurance in and around Mendota

Looking for renters insurance in Mendota?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Mendota

- Lamoille

- Amboy

- Earlville

- Troy Grove

- Triumph

- Paw Paw

- West Brooklyn

- Sublette

- Cherry

- Ohio

- Henry

- Peru

- Lasalle

- Ottawa

- Spring Valley

- Rochelle

- Dixon

- Rock Falls

- Sterling

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or condo, renters insurance can be the right decision to protect your belongings, including your golf clubs, tools, desk, books, and more.

Looking for renters insurance in Mendota?

Coverage for what's yours, in your rented home

Agent Kurt Bruno, At Your Service

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Mendota. Get in touch with agent Kurt Bruno's office to discover a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Kurt at (815) 539-3878 or visit our FAQ page.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.